The Staggering Costs of Elder Care in America

My Experience with Medicaid, and Threats our Safety Net faces

Once we moved my mom into assisted living, it didn’t take long to figure out that she would run out of money. She actually had a decent amount saved for retirement, plus some equity in her home, which should have allowed her to maintain her middle class lifestyle well into her 90s. The problem was, like most retirement planning, this assumed she would be able to age in place, without the additional costs that come with illness or disability. That’s what most of us want to assume will be the case. The truth is we are not able to predict a sudden illness, followed by an extended hospital stay that surfaces a dementia diagnosis, or any of the many other possible health challenges. When Long Term Care is needed, costs escalate immediately, and dramatically.

The first assisted living that we moved my mom into didn’t seem that expensive, compared with others and in the context of Seattle rents. I had no previous experience with elder care, but soon learned that the base price is only a fraction of what you will pay. The medical costs that are added on can be increased at any time as decided by the facility. I learned that, for example, my mom deciding she wanted her meal delivered to her room incurred an extra charge each time. The charges added up.

When I found that facility, I didn’t even know to ask if they accepted Medicaid. Spoiler: they did not. I had used a service called A Place for Mom to help find the assisted living; what I didn’t realize is that the service doesn’t work with any places that accept Medicaid. Ah, the little (big) details you don’t realize are important when you’re making a major decision under pressure.

Medicaid is the main program that provides health care and long term support services for low income populations - 94 million people - in the United States. Many people who need long term care end up going on Medicaid when their money runs out. Five in eight nursing home residents are on Medicaid, and it covers health care for the most vulnerable populations, including folks with disabilities and children. It’s a federal program administered by states, so states each have their own guidelines and limits within the federal mandate.

Eventually my mom was paying about three times what we had initially signed up for, in the neighborhood of $10k per month. Any type of live-in elder care seems to cost more than you think it will, which is unbelievably expensive - even as they struggle to maintain quality staff. Just as in childcare, it is easy to see why subsidies of some kind are critical.

When I realized that her financial runway had become even shorter and that, at the current rate of spending, my mom would run out of money in a couple of years, I scrambled to look for options and to learn about Medicaid. I found a well-regarded nursing home that accepts Medicaid, and got my mom on the wait list. A year and a half and several “squeaky wheel” phone calls later - and about six months before spending most of her money - she was offered a room. The out of pocket costs in this non profit nursing home are in the range of $15k per month.

Sometimes I still feel some guilt for not having gone to greater lengths to keep her in her home longer, or not somehow figuring out how to make her money stretch out further. I have also felt frustration that she did not plan for, or want to discuss at any point, the possibility of not being able to live alone, or share any of her finances in advance. The latter made it administratively difficult and time consuming for me to manage - while juggling two young kids and a third on the way. The truth is, many families don’t talk about these things until it’s an emergency, and I did the best I could.1

My brother who has significant developmental disabilities and has 24 hour support is also covered by Medicaid. Fortunately, his services were all set up before I got involved with his care and became his guardian, though it also meant I didn’t actually have experience with the process when it came to getting my mom enrolled. He is well cared for, also by a nonprofit organization, and his benefits cover his rent, care, and other programs such as community integration. It’s hard to imagine how we would have managed his care all of these years, or how he would have gained the independence he has, without Medicaid.

Dealing with administrative bureaucracy is not fun, but it’s worse when you get thrown into it, completely unprepared. If you think it might be in your (loved ones’) future, it doesn’t hurt to start looking into the requirements now. I’m no expert, but I can share some lessons from going through the Medicaid enrollment process.

Advice from my Medicaid experience

If you think medicaid will be in your (loved one’s) future, and you are looking into assisted living or nursing homes, make sure that the place you choose will accept medicaid! Many do not. And many have waiting periods and spend-down requirements - meaning you may have to spend hundreds of thousands with that facility before they will accept medicaid. We were able to find a non-profit nursing home with no spend down, which is rare, but we were on the wait list for a year and a half.

Simplify finances as a first step. My mom had accounts all over the place, which made it a headache to figure out how much she had and what was going into, and coming out of which accounts. I closed accounts that weren’t needed, got her income sources (small pension and social security) going into one account, and her expenses coming out of the same. I kept one other account for the funds we were allowed to keep aside for burial expenses.

Start the process early. I got conflicting advice about this. On the one hand, I was told by the social worker at my mother’s nursing home that if you submit an application before you spend down your resources to under $2k, your application will be rejected. While this is true, I can now see the benefit of getting advice and starting the planning earlier. See the next point.

There are steps we could have taken in advance in order to set aside more of my mom’s resources before spending down every last cent in order to get benefits. There are types of irrevocable trusts you can set up that allow you keep some funds or pass them to family without penalties. In our case, I was at least able to transfer some resources to my disabled brothers’ Irrevocable Trust account, which has been so useful to pay for legal fees related to guardianship, and bigger purchases for him like a new piece of furniture. I’m grateful that my internet research surfaced this beforehand, but also wish I would have planned further out. You can also set aside burial funds.

Consider hiring a Medicaid Specialist. I was given this advice, but at the time thought it was strange to pay someone to simply file for aid. However because they know the ins and outs, they can help you take the right steps in the right order, and help you potentially keep any funds that are allowable. They also have relationships with the folks in the local medicaid offices.

Get friendly with the specific person handling your case. Plan to spend a lot of time communicating with them directly, including actually picking up the phone when things need to be clarified and dealt with ASAP. We had an issue with my mom’s personal expected contribution being miscalculated, and knowing the person who was handling my mom’s case was helpful.

Honestly, there is so much that I don’t know, but these are a few things I would have told myself before starting the process. Also important to note - as I mentioned above, each state has their own set of requirements, limits and processes, so when it comes to finding planning resources, be sure to look at the ones specific to your state.

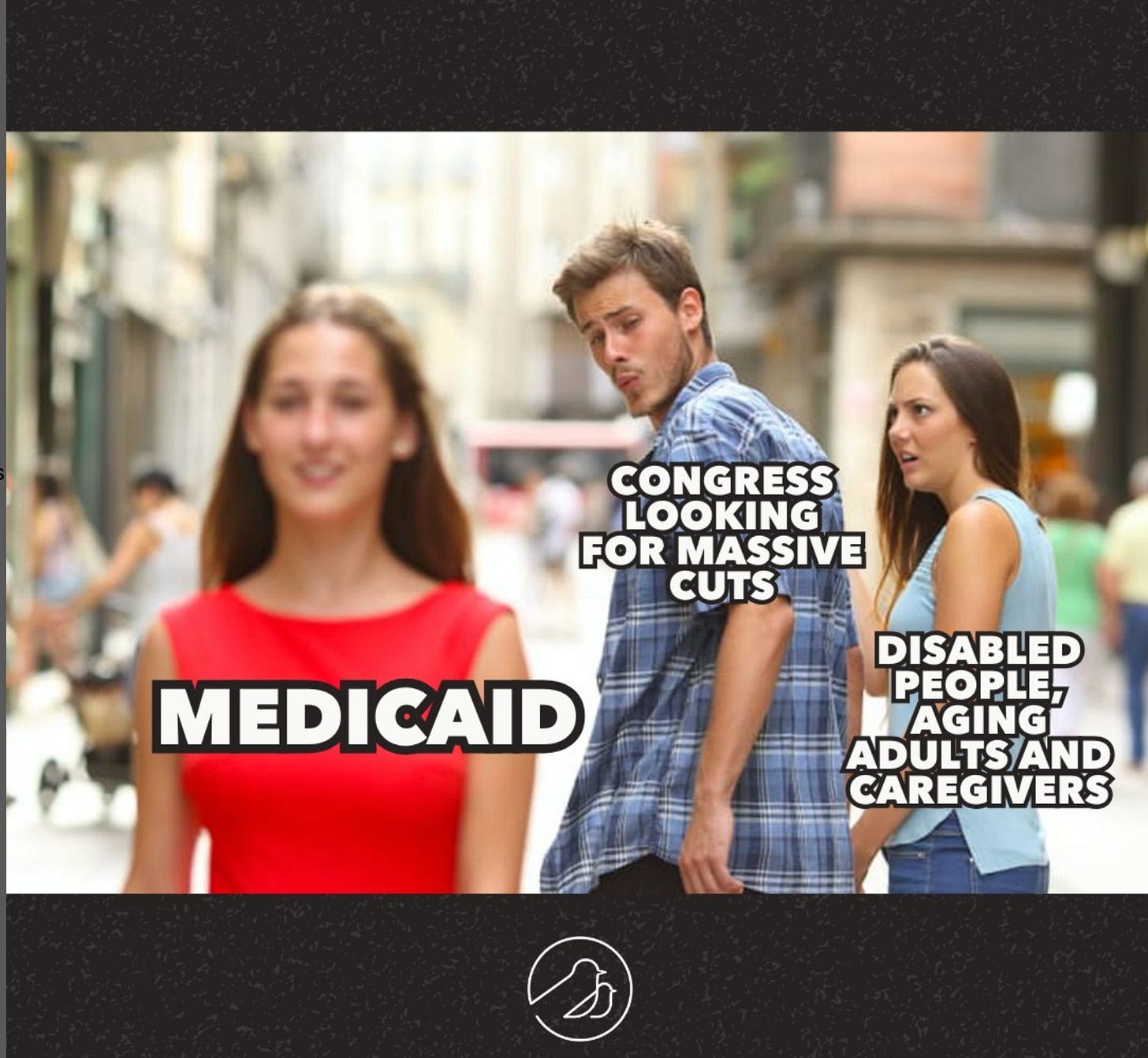

Medicaid is at Risk

We don’t know what will ultimately happen, House Republicans are considering massive cuts to the Medicaid program - $2.3 Trillion - which would represent about one third of the program budget. In this scenario, many people would become ineligible and lose coverage altogether, others would see decreased coverage, payments to providers would decrease (leading to less providers willing to accept Medicaid) and state budgets would face major risk.

Large studies have shown the positive impact of Medicaid on access to and quality of health care, insured rates, and health outcomes particularly for underserved populations. Children in particular who benefitted from Medicaid access showed improve health outcomes into adulthood, as well as improved educational attainment. It is a program that has largely bipartisan support, though many Republicans would likely get on board with scaling back the Affordable Healthcare Act expansions.

On a personal level, I can’t imagine navigating the care for my brother and mother without Medicaid. Both need full time support and cannot work. What would we do? What will the growing aging population do when resources run out?

Perhaps some of the health tech companies that are looking to be part of the Medicaid ecosystem will spur investment and create efficiencies in the system. There is certainly much room for innovation. But it’s unnerving and unrealistic to believe we can depend on tech and impact investing to fill in the gaps for the most vulnerable populations if public funding gets abruptly slashed.

Do you have experience with Medicaid and tips you can share? Or thoughts about what changes to the program might look like? Share them in the comments!

Please ❤️ and share to help this be seen by more people!

Another plug to get your shit together (i.e. have a will and a plan for different aging scenarios)!

Thank you for sharing this! I’m sorry you’ve had to go through so many challenges. My Mom just we t through many of these issues with my Grandma and I know we’ll face similar ones in our future. It helps to have as much transparency about the process as possible! 💗

This is so helpful. And I’m sorry it’s been such a slog for you, with your mom. I think your dad has the right idea!